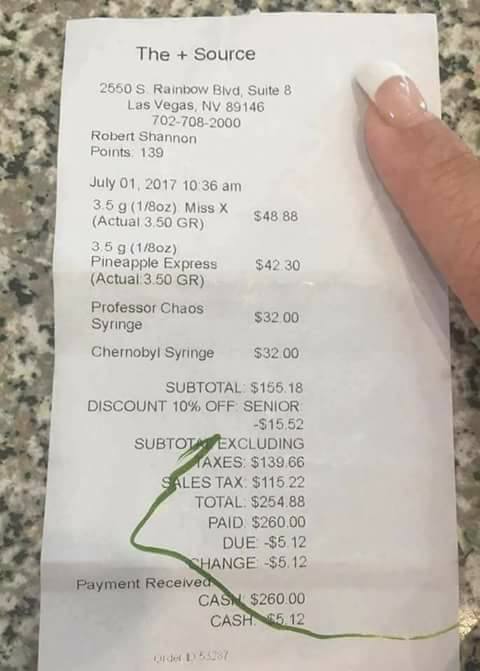

From this receipt it looks like the tax rate on marijuana in Nevada is 90%.

They purchased $155.18 worth of marijuana.

And they paid $139.66 in taxes on the marijuana.

That is a tax rate of 90%.

The folks that run the Nevada government are a bunch of crooks!!!!!

I guess things could be worse. Here in Arizona, US Congresswoman Kyrsten Sinema, who at the time was a member of the Arizona legislator tried to slap a 300% tax on medical marijuana in Arizona for her police buddies.

Since medical marijuana goes for about $300 an ounce in Arizona, that would have placed a $900 an ounce tax on an ounce of marijuana that costs $300, bringing the total price to $1,200 an ounce.

I suspect US Congresswoman Kyrsten Sinema tried to slap that $900 and ounce tax on medical marijuana to make it effectively legal.

Thank God that law didn't pass.

If you want complete and total legalization of marijuana support the RAD or Relegalize All Drugs initiative.

Here is a link to the initiative:

http://relegalize.100webspace.net/legalize_marijuana_2018.php

The RAD initiative doesn't let the government tax marijuana for this very reason. We know the government ruler want to tax the krap out of marijuana users so they can give the stolen loot to the special interest groups that helped them get elected. And that's wrong.

Sounds like Ria is right. This article gives tax rates for Nevada marijuana as 10%, 15% and 32%.

The very last line in this article seems to state all the taxes that will be paid on recreational marijuana in Nevada:

Beginning July 1, recreational marijuana will be taxed an additional 10 percent on top of the state’s 6.85 percent sales tax and any local sales taxes, and the 15 percent marijuana wholesale excise tax.

That gives a total retail tax of 15.85% and a wholesale tax of 15%.

Lessons Learned? Nevada Tax Strategy for Recreational and Medical Marijuana

June 23, 2017

Lindsey Lassiter

Matthew Stadnicki

On July 1, Nevada retailers plan to begin selling recreational marijuana, seven months after recreational marijuana usage was approved by the Question 2 ballot measure. Nevada lawmakers needed to move swiftly, but thoughtfully, to establish regulation and collection of taxes on recreational marijuana sales.

When the 2017 legislative session adjourned on June 6, Nevada lawmakers had approved a series of bills that answered key questions about how recreational marijuana would be introduced to the legal market. The legislature combed through 23 marijuana-related bills, covering everything from protecting the medical marijuana market, youth safety around marijuana products, and how to tax the industry. Most relevant to the discussion here is Senate Bill 487. This was one of a handful of bills that passed the legislative session, and it added a 10 percent excise tax to the sale of recreational marijuana. An amendment to the bill, which was added on June 4, equalized the wholesale excise tax rate for both medical and recreational marijuana at 15 percent.

So, five years after legalization in Washington and Colorado, did Nevada learn the lessons of its predecessors? In a Tax Foundation 2016 report, we outlined five lessons that states should consider:

1. The marijuana tax rate should not be so high as to prevent elimination of the black market

Once the wholesale excise tax established in Question 2 and sales taxes are taken into account, the tax rate on recreational marijuana in Nevada will be approximately 32 percent. Colorado and Washington both initially levied tax rates of over 30 percent and struggled to reduce the size of the black market. Nevada could face similar troubles stamping out the black market.

2. Tax rates on final retail sales have proven the most workable form of taxation

Nevada has opted for a somewhat administratively burdensome method of taxation, but has taken steps to reduce complexity between medical and recreational marijuana cultivation operations. An approved amendment to Senate Bill 487 equalized the medical and recreational wholesale excise tax rates at 15 percent. Wholesale excise taxes on medical and recreation marijuana were set at two rates. The 15 percent wholesale excise tax is paid by the cultivators and the final 10 percent recreational excise tax is paid by the consumer. In Colorado, which has two wholesale excise tax rates, cultivators must separate the two inventories throughout the supply chain, causing operational headaches and inefficiencies. Even though the wholesale excise tax is not optimal, compliance will now be less complicated.

3. Be conscious of the medical marijuana market

The 10 percent tax differential between medical and recreational marijuana may or may not result in less recreational marijuana tax revenue. There are costs associated with obtaining a medical marijuana card, and purchasing on the black market carries its own risks. Consumers may decide to pay the additional 10 percent tax to avoid the hassle. However, they could also decide 10 percent is too much of premium and purchase medical marijuana from the black market. It is unclear whether this premium will be too high. The lesson from Washington is to avoid a very large gap between tax rates.

4. Be cautious with revenue estimates

Both Washington and Colorado experienced lower revenues than predicted for a variety of reasons, such as estimating the size of a previously illegal market, potential substitution with medical marijuana, and the regulatory structures in place. Nevada estimates that the state will raise over $48 million from sales. A gap between estimated and realized revenue is likely, at least initially, so Nevada has opted to allocate marijuana tax revenue to the state’s rainy-day fund. Nevada lawmakers believe that it is better for the rainy-day fund to experience instability rather than depending on revenue that might not materialize.

5. Resolve health, agricultural, zoning, local enforcement, and criminal penalty issues

Nevada’s Question 2 still left many important issues on the table for lawmakers to address. Question 2 gave prior alcohol distributors in Nevada the sole right to distribute retail marijuana unless an insufficient number of liquor establishments applied for licenses. The Independent Alcohol Distributors of Nevada have sued the Department of Taxation to suspend the granting of marijuana distribution licenses to non-liquor establishments despite only five liquor establishments applying for a license so far. This lawsuit and any others stemming from unaddressed pieces of implementation could slow the process and affect revenue projections.

On June 12, Governor Sandoval (R) signed Senate Bill 487, along with certain other pieces of marijuana legislation. Beginning July 1, recreational marijuana will be taxed an additional 10 percent on top of the state’s 6.85 percent sales tax and any local sales taxes, and the 15 percent marijuana wholesale excise tax.